“For many goods and services, price is the #1 factor which influences a purchase decision.” — Christian Kluge

In business, we’re often taught that higher sales volumes and reduced costs pave the path to profit enlightenment. But this overlooks one key fact — that in most cases, pricing will likely be the #1 driver of higher profits. To kick off our new #PricingBasics blog series, let’s delve into why pricing has such a significant impact on how your business performs.

Remember the last time you stood in front of your local supermarket’s wine shelf? What were you thinking about as you mulled over which wine to buy? What influenced your final decision? We’re willing to bet that price played some part in attracting you to that particular bottle.

Research suggests that, for 70% of consumers, price is either very important (15%) or important (55%) in making their purchasing decision.

Just how much influence pricing has on purchasing decisions varies according to the type of goods or service bought. This variability in the importance of pricing is known as price elasticity and will be explored later in this series of blogs. Typically, however, for the vast majority of goods and services, price is one of the top three factors customers consider at point of purchase.

for most companies, price is the #1 profit driver

PROFITS = QUANTITY X PRICE ー COSTS

This simple mathematical formula captures something fundamental about the role price plays in the profit equation. Most obviously, it shows that by changing the price, you can change your profits. But what is also very special about price in this equation is that it has no impact on costs. Most activities undertaken to drive up sales volumes — marketing campaigns, for example — also involve raising additional costs, reducing the impact on profits.

But price is not like that. However you choose to alter your pricing strategy, the effect on profit will be direct, without being mitigated by changes to costs.

We have been struck by how often managers overlook these key facts about price. They will happily invest enormous sums in marketing and sales to drive volume, or go through several rounds of cost cutting. The benefits of pricing structure and optimisation are often fairly new to them.

Let’s take a closer look at the potential impact of pricing strategy using this simple profit equation.

Imagine you are running a company that sells one million products at €100 each. Your variable and fixed costs are €40m each, creating total costs of €80m. That gives you profits of €20m.

Now consider what would happen if…

- …you optimized price by +10%.

- …you sold more and increased quantity by +10%.

- …you reduced your fixed costs by -10%.

- …you reduced your variable costs by -10%.

If you run all of these figures through the profit equation once more, while keeping the other three as they were, you will see that a 10% increase in price (so €110 per unit) achieves the biggest increase in profit:

€110 x 1million ー €40m ー €40m = €30m

An impressive 50% increase for a 10% change. A 10% improvement in volume only raises profits by 30%; a 10% reduction in fixed or variable costs just 20% each.

So pricing optimization will have the biggest impact on your profits out of all the factors involved in the profit equation. However, to take full advantage of the benefits, there are some other factors businesses also need to consider.

five further considerations around pricing

1. Digitization has boosted speed of implementation:

One of the reasons so many businesses perhaps overlook pricing strategy as they look to boost profits is the perception that price alterations are logistically cumbersome and take too much time to take effect. In the old days of manually adjusting pricing spreadsheets and printed labels, this might have been the case. But with modern digitalized systems, businesses can adjust prices centrally and have them applied on shelf and at point of sale in seconds, meaning the impact on profits can be rapid.

2. Price is a top attention grabber:

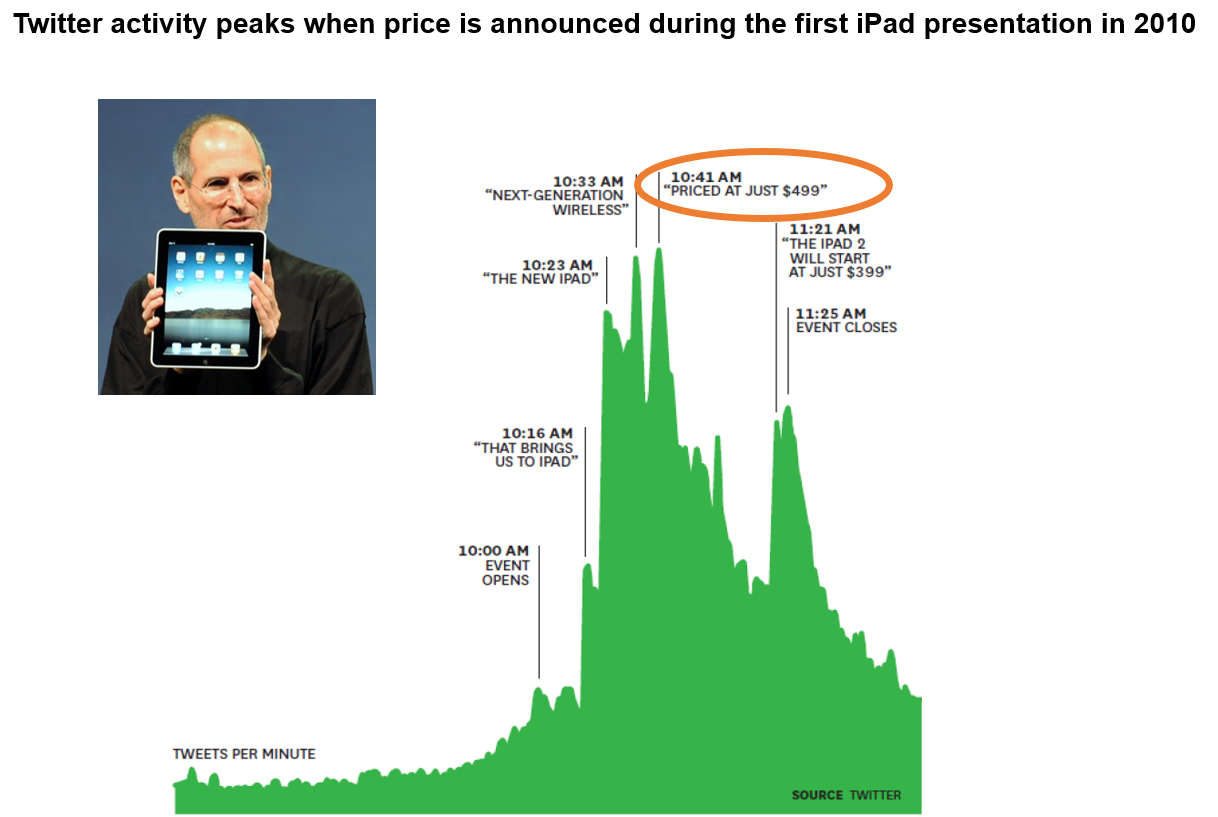

We’ve mentioned how businesses often have to invest heavily in marketing when their aim is to drive up sales volumes. Pricing is a topic that instantly grabs attention and, with the right approach, can drive its own awareness-raising campaign to support greater sales. This is something very much evident in the social media age — look, for example, at how Twitter conversations about the original iPad release spiked when Steve Jobs announced the price during his famous 2010 unveiling.

3. Customers must buy-in:

Social media reactions to pricing also signal an area where businesses need to be careful how they tread. Another factor in the profit calculation is that customers do not always react kindly to price hikes. Any increase perceived as being unfair or which looks like profiteering can nowadays provoke furious social media backlash. Such negative reactions are spread rapidly and can undermine efforts to increase profits.

4. Companies should remain flexible with their pricing:

The role of customer reactions in the success of pricing strategies underlines how businesses need to be flexible in their approach. If a price increase is received badly by the market, then you must be willing to change — otherwise people will stop buying your product and your profits will fall. On the flipside, there are many stories of brands getting locked into the discounter mentality, on the basis that low prices will attract customer loyalty and drive sales volumes. But long term this can be destructive. A famous case is Praktiker, formerly one of the top German home improvement retailers that traded on the slogan “20% on everything except animal food” and eventually went bankrupt when it found it couldn’t sustain margins.

5. Pricing strategy must align with company strategy:

How you approach pricing is an extension of your company strategy. It will influence how you position yourself in the market in relation to other competitors, how customers perceive you, how you market yourself, your cost-cutting requirements to sustain margins and so on. But as the Praktiker story cautions, there are dangers in creating an entire company identity around pricing. The most successful companies are agile and able to predict and respond to changing demands in the market. This kind of mindset should be reflected in pricing strategy too.

. . .

In our next post, we will introduce the concept of price-demand curves. Following on from some of the points made above, price demand curves demonstrate the relationship between the price of goods and services and how many items are sold. Understanding them is key to optimizing your profits. We will discuss the different models and how they can be used to adjust the basic profit calculation formula for greater accuracy.

th!nkpricing is a brand of Smart Pricer. We are making professional pricing accessible to everyone by offering a platform to understand, simulate, and optimize your pricing with machine learning-driven algorithms and advanced demand prediction.

Subscribe to our Newsletter and be among the first ones to learn about the rules of Pricing.